Introducing the Gilt Ladder Hedge App

A practical tool for hedging user-defined [UK] cash flows.

What is This App, and Why Does it Exist?

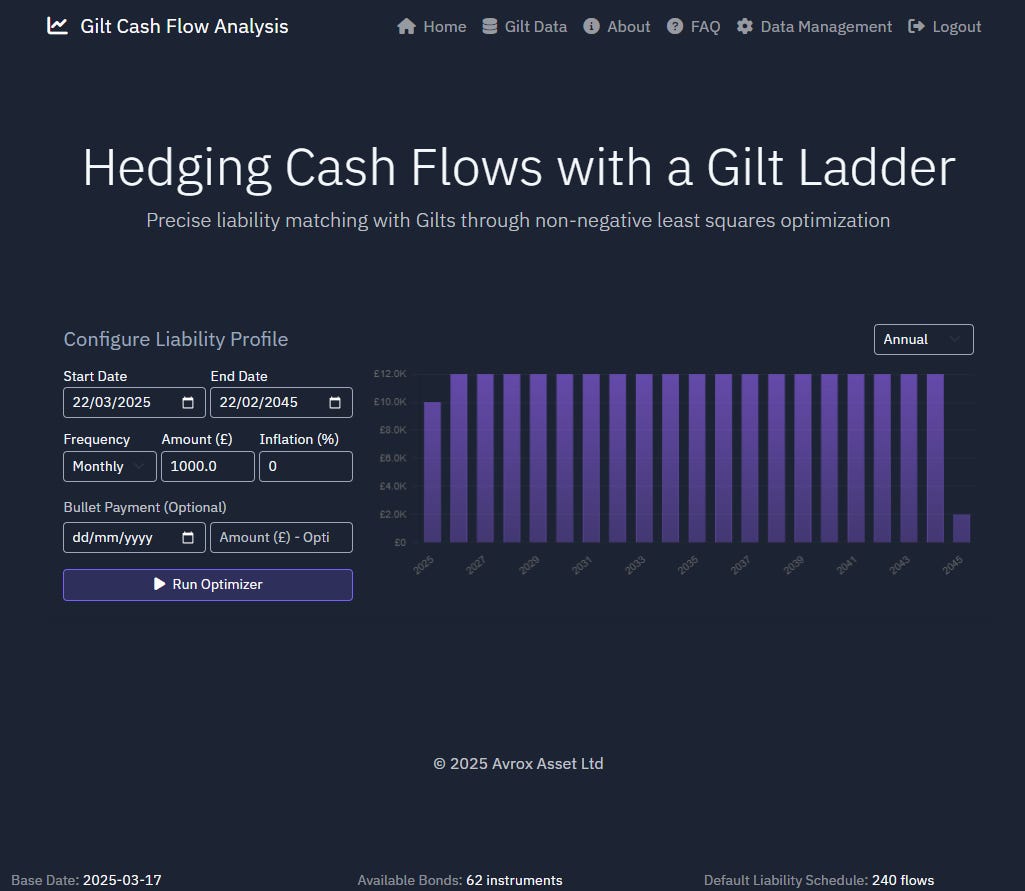

The Gilt Ladder Hedge app is an educational tool designed to explore how a portfolio of Gilts can be structured to hedge a set of future cash flows. Using linear algebra and a non-negative least squares (NNLS) approach, it solves for a portfolio that best matches a user-defined series of nominal payments.

This isn’t a financial product or investment advice—just a way to visualise how this type of hedging might be approached in practice. It can be used to experiment with different scenarios and gain insight into how interest rate risk can be managed using conventional Gilts.

How It Works

The app is straightforward:

Define Your Cash Flow Profile

Enter a series of future nominal payments you’d like to hedge.

Apply a growth rate assumption for inflation (optional).

Include an additional bullet payment if needed.

The Algorithm Runs a Hedge Solution

The app doesn’t use inflation-linked bonds—just conventional Gilts.

It calculates the optimal mix of Gilts to hedge your future cash flows.

The underlying maths uses NNLS (non-negative least squares) to solve for the best fit.

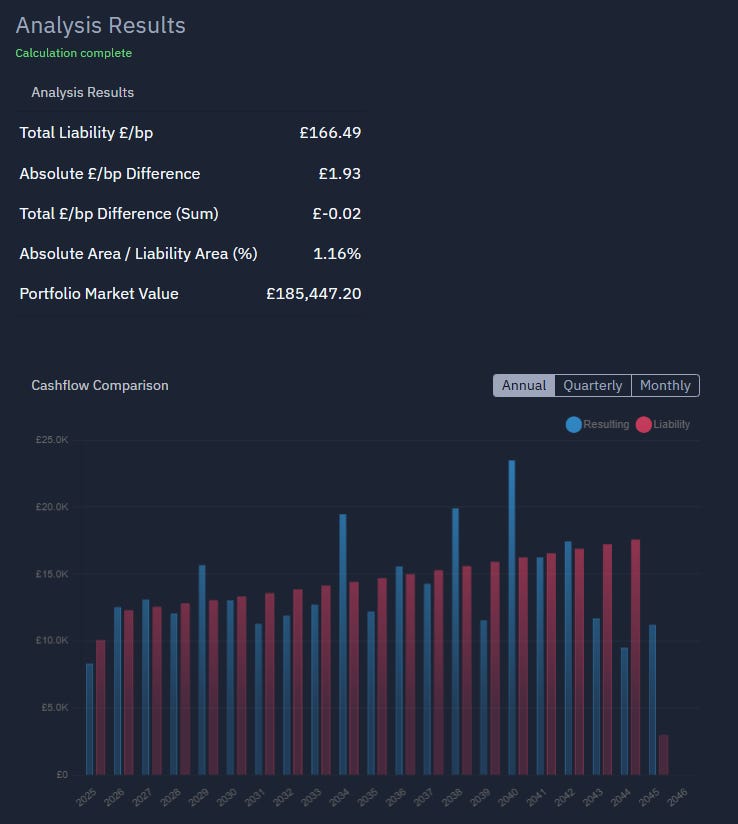

Review the Results

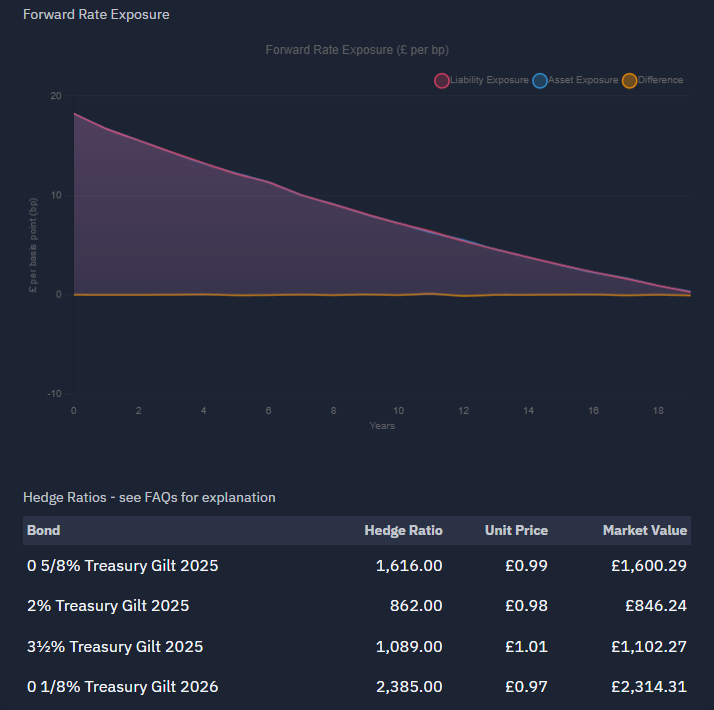

See the resulting hedge portfolio, including model prices and estimated market value.

Metrics such as net exposure and gross difference help assess how well the hedge aligns with the target cash flows.

A forward rate exposure graph visualises the overall match achieved.

The app deliberately uses model prices rather than live market data, meaning the outputs are illustrative rather than exact. However, the core principles of the hedge remain valid.

Who Might Find This Interesting?

This app is designed for educational and exploratory purposes. It may be of interest to:

Those looking to understand how interest rate risk can be hedged using Gilts.

Anyone curious about liability-driven investing and fixed-income strategies.

People who enjoy experimenting with financial models and exploring how different hedge structures work.

It’s important to emphasise that this is not a tool for making investment decisions, nor does it provide financial advice. It’s simply a way to see how this kind of problem can be approached using mathematical optimisation.

FAQs

Is this financial advice?

No! This is purely an educational tool to show how you might go about solving this problem. The numbers are model-based, and the outputs aren’t intended for actual investment decision-making.

Why doesn’t it use inflation-linked bonds?

The app is focused on hedging nominal cash flows using conventional Gilts. If there’s demand for an inflation-linked bond version, I’d be happy to explore it in future.

How accurate are the prices used?

The app uses model prices, not real-time market data. While these may be out of date, they don’t materially affect the structure of the hedge itself.

Could you use this for cash flows other than GBP?

The app is designed specifically for GBP cash flows and uses model prices and the details of outstanding UK Gilts. However, in principle, a similar approach could be applied to other currencies, provided there are liquid government bond markets with a range of maturities available. If there’s interest, I’d be happy to explore the feasibility of adapting the model for other currencies in the future.

Could this become a commercial tool?

Possibly! Right now, this is a personal project linked to this blog, but I’d be open to discussing additional features or potential applications. If anyone is interested, I’d love to hear from you.

Can I support the project?

Some people kindly contribute towards my work, and I’m very grateful for that. If you find the app useful and want to see more, feel free to upgrade your subscription to this blog.

Final Thoughts

The Gilt Ladder Hedge app is a niche but hopefully helpful tool for exploring how Gilt-based hedging works. It’s a way to experiment, learn, and visualise interest rate hedging and benchmark creation in an interactive way.

🔗 Try it out here: Gilt Ladder Hedge App

If you have any thoughts, feedback, or ideas for additional features, I’d love to hear from you! Please feel free to share this or the App, and please tell me about bugs and errors (there might be many).

For those interested, I’m not a programmer (at all), and this App was built using AI tools that are now available. I’m staggered by what is now possible with these tools.

This project aligns with my broader exploration of Modern Tontines and innovative approaches to retirement finance, which I discuss in this blog. At its core, Modern Tontines are about pooling longevity risk through collective financial structures, but a key component of any effective retirement strategy is ensuring stable, predictable income. The Gilt Ladder Hedge app provides a hands-on way to explore how future cash flows can be matched with secure, interest-rate hedged assets—something that sits at the intersection of traditional annuities, pension design, and emerging Modern Tontine models. Whether you’re interested in how to construct an income stream or just enjoy financial modelling, I hope this tool adds another layer to the discussion.