Secure Lifetime Income is a great idea—so why lock out the under‑55s?

Secure Lifetime Income is an annuity bought within a SIPP, where, rather than having to take the income, you can decide whether to withdraw it or reinvest it.

Opinion | Retirement & Pensions

I have recently discovered Secure Lifetime Income (SLI), the in-SIPP annuity now offered by Just Group and Phoenix/Standard Life. Its design is quietly radical: the SIPP trustee buys a slice of guaranteed lifetime income, payments flow into the pension cash account gross, and each year the saver decides whether to spend or reinvest them. This introduces an element of certainty to the volatility of drawdown, allowing you to compound those “mortality credits” inside the tax wrapper by buying additional SLI annuities with the income for as long as desired.

Unfortunately, the system only partially treats an SLI as an asset. Because HMRC classifies “becoming entitled to a lifetime annuity” as Benefit‑Crystallisation Event 4 (BCE 4) (Legislation.gov.uk), platforms must first move the cash into flexi-access drawdown before placing the order. This creates two limitations:

you must be at least 55 (57 from 2028), the Normal Minimum Pension Age.

Any new contributions made after the purchase sit in an uncrystallised pot and cannot join the SLI until they, too, are crystallised (a huge admin and fee headache).

The providers cannot change these rules; their own literature makes the point bluntly: “To be eligible, the client must have crystallised funds held within a personal pension and be aged 55‑90.” (justadviser.com)

The missed opportunity: compounding mortality credits

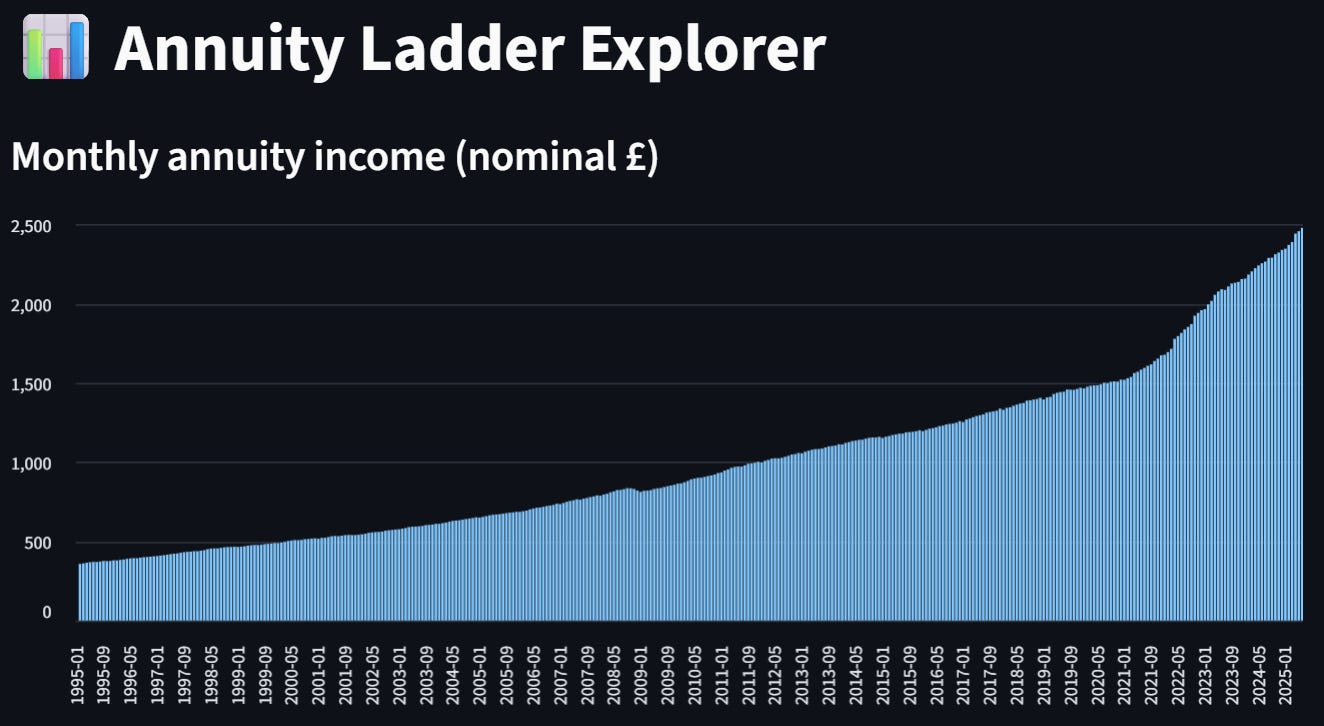

Consider this: had a 35‑year‑old invested £100,000 in an immediately paying, index-linked SLI annuity in 1995, reinvesting each month's income into new tranches, they would now, at 65, hold 360 separate inflation-proof contracts. This ladder of small annuities would be paying approximately £30,000 annually, RPI-linked for life, driven by risk-free index-linked yields and compounded pooled longevity risk. Remarkably, this is with the historically low yields over much of the period and includes a hefty 1% annual fee for insurers and platforms.

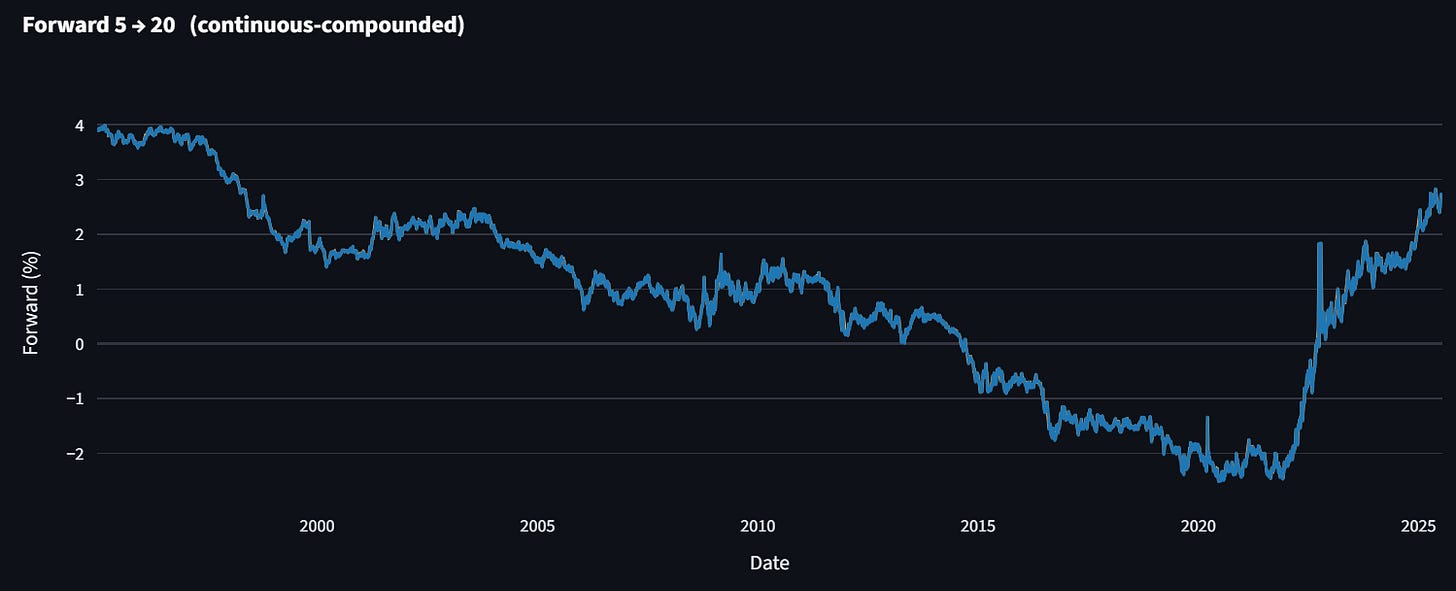

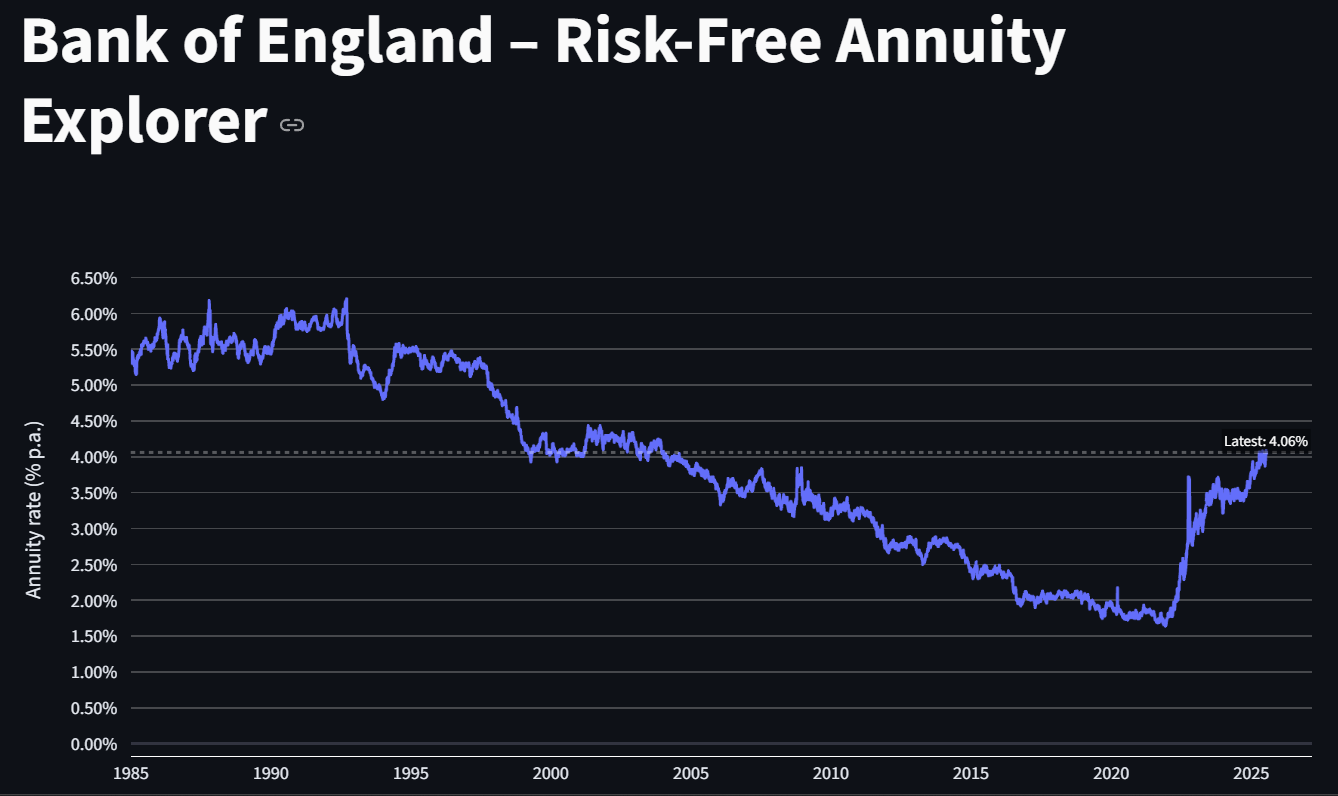

The maths is not magic; it is the power of a guaranteed income compounding on itself. Yet today’s saver can't embark on this journey until age 55, and forced crystallisation removes future lump-sum flexibility that many savers understandably want to preserve. Consequently, take-up remains limited. What makes this especially unfortunate is that today's index-linked yields have returned to genuinely attractive levels, as indicated by recent yield curves. The chart below is a proxy for index-linked real (pre-inflation) yields.

Before the “You must take equity risk” advocates object, I acknowledge that £100,000 invested in equities might have generated a larger pot, depending on asset allocation and fees. Outcomes inevitably vary, and my point isn't to dissuade from taking investment risks but to highlight the value in clearly framing and comparing them against a transparent, risk-free alternative.

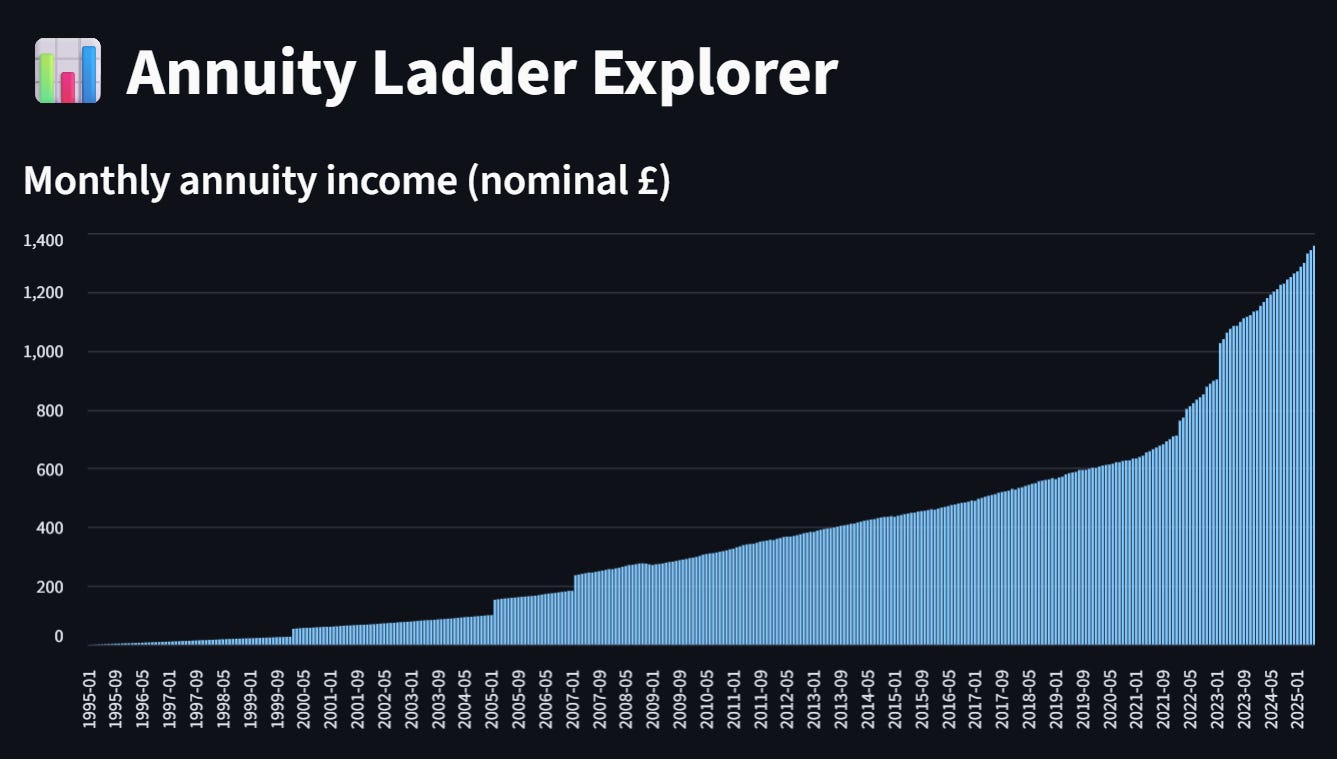

Admittedly, not many people have £100,000 to invest at 35, so let's consider a more realistic scenario. A saver earning £12,500 in 1995, with real salary growth of 3% and monthly savings of 10%, would now have an £8,400 annual RPI-linked pension at 65. Adding a few strategic lump-sum contributions—£10,000 in 2000, £20,000 in 2005, £20,000 in 2007, £20,000 in 2022, and £30,000 in 2023—would yield approximately £16,500 per year, inflation-linked.

The pathways for such simulations are endless, but the core idea is clear: this extremely low-risk retirement savings approach should at least be available. It offers transparency, clarity, and security, empowering savers to see precisely what pension they will have each month during their working life, enabling them to make an informed decision about when to retire.

A modest proposal

Re‑label in‑SIPP annuities as “assets in accumulation” until cash is actually withdrawn.

Allow purchase from uncrystallised funds; record the notional value for lump sum allowance purposes.

Mandate full disclosure of inflation and liquidity risks to satisfy Consumer Duty requirements, while recognising that an irredeemable bond yielding 3% real can still represent fair value to a knowledgeable 40-year-old.

SLI is arguably the most promising retirement innovation since the introduction of pension freedom. Yet by defining it strictly as a benefit rather than an asset, the policy unnecessarily restricts its advantages to the last decade of working life. Allowing younger savers to harvest mortality credits over a longer period would encourage the market to develop innovative, flexible, and index-linked retirement products that consumers truly need.

More broadly, this could also open the door to integrating Modern Tontines into retirement accounts. Modern Tontines would permit savers to compound mortality credits alongside their investment risk, significantly enhancing effective annuity yields. Offering savers the choice to purchase structured Tontines from various providers competing directly with annuities could lead to genuinely modern retirement solutions—solutions well-suited to the longevity challenges ahead.

Thank you for reading and supporting the Campaign for Modern Tontines. This is a reader-supported blog, sustained by voluntary contributions from people like you. As a contributor, you'll gain exclusive access to the tools and apps I'm building, designed to help you explore, understand, and model these innovative retirement solutions.