About

The retirement crisis is real, and it's time to demand new solutions - join the campaign for Modern Tontines

A warm welcome to my new subscribers, and thank you all for supporting this SubStack. The posts are free and will stay that way. The only reason to upgrade is to support this campaign; a big thank you to those of you who have chosen to do just that! It really is very appreciated and a bit surprising; I’m brainstorming possible ways to reward your generosity; in the meantime, please get in touch to share any ideas or comments!

Join our pioneering campaign to bring Modern Tontines from mere concept to an investable reality. In the face of an impending retirement crisis, Modern Tontines stand out as a pragmatic solution, yet they're tangled in a web of historical controversy and legal ambiguity. Your support is essential. Together, we can galvanise the investment community and regulatory bodies into action. Let's lead the charge in transforming Modern Tontines into a practical tool for safeguarding our financial futures. Your involvement could be the turning point in this innovative endeavour.

This is Modern Tontines, the start of a campaign to make Modern Tontines and Target Date Fund Ladders a reality. Modern Tontines don't exist yet1 despite them being a realistic solution [partial solution] to the looming retirement crisis. Target Date Fund funds exist, but not enough of them to make an effective ladder2. They'll need a collective effort on all our parts to make them a reality.

Why subscribe?

By joining the campaign for Modern Tontines, you can help raise awareness about the looming retirement crisis and push for new, innovative options that can help secure our financial futures. The posts on this blog are and will be free!

Modern Tontines don't exist yet, despite them being a realistic solution [partial solution] to the looming retirement crisis. They'll need a collective effort on all our parts to make them a reality.

About me

I used to be a macro fund, pension and insurance portfolio manager. I spent my career managing an array of products, from those backing defined pension plans, annuities and life insurance books to absolute return products designed to help wealth managers diversify client portfolios.

My career as a Fund Manager shadowed the slow death spiral that has engulfed the UK defined benefit (DB) pension fund system, starting as it did with the arrival of the Minimum Funding Requirement (MFR) in 1997.

Why am I doing this?

The closure of DB pension funds to new and now existing members has deprived us of a secure retirement and the considerable benefits of risk sharing, or more technically, longevity risk sharing.

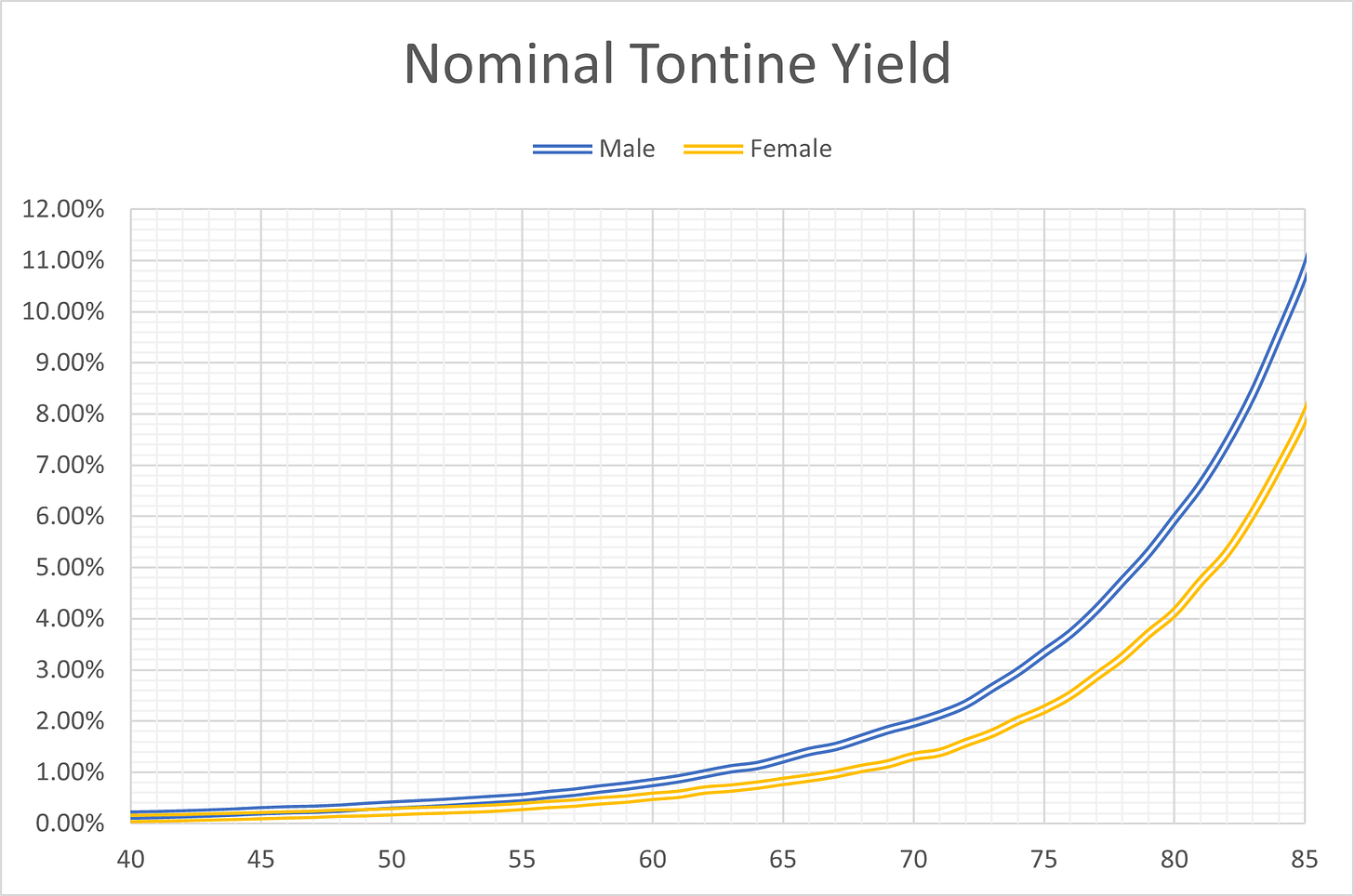

We are left now with the vacuously named “defined contribution” or money purchase scheme. Here, your retirement security is defined by drawing down your savings in a sensible way, meaning you miss out on the Longevity risk-sharing yield as shown, and you could be paralysed by risk aversion when considering the risk that you live for much longer than expected.

You might be able to get some exposure to the benefits of longevity risk sharing by buying an annuity, but these, alas, rob us of investment returns, which are spirited away to the insurance company's shareholders along with their not-inconsiderable fees. They are still worth investigating, though.

To alleviate the looming retirement crisis, we need exposure to both longevity risk sharing and investment returns. Modern Tontines are part of the solution. Help me make them a reality.

What do I get out of it?

My company - Avrox - The Fair Tontine Engine - has built the nuts and bolts (technology) to make fair distributions within a Modern Tontine or Collective Defined Contribution (CDC) structure, a simple SAAS subscription. We also have detailed ideas on how you could run one of these longevity-sharing pools transparently and fairly. We’re ready and willing to work with the industry to make these a reality, but we need your help to persuade the investment community to run with the idea.

Potential Clients should join as Founder Members and be part of the group defining the modelling development, get information about company activities, and be invited to participate in funding rounds as this start-up develops.

There are some notable efforts to bring Modern Tontines to the market. We’ll discuss them in future posts.

Subject of a future post. Many people will question why you need a Target Date Fund Ladder when you could approximate the asset allocation with a simpler lifestyle fund. The answer is a purely practical one. More later.