# 💡 Hedging a Forward-Starting Annuity: A Practical Approach

This might sound a bit complex, but bear with me—it’s more straightforward than it appears.

In this piece, I'll go through the [my] process for hedging a forward-starting annuity using Gilts. I’ll briefly discuss the concept of hedge pricing and suggest that real-world annuity pricing connects to simple Gilt portfolios that can actually be traded1.

Disclaimer: Views are my own. This post is for information and education only and is not investment, legal or tax advice. Nothing here is a recommendation or an invitation to engage in investment activity. Do your own research and, if needed, speak to an FCA-authorised adviser. I may hold positions related to the topics discussed.

🔁 What Is a Forward-Starting Annuity?

A forward-starting annuity is precisely what the name suggests: an annuity where the income payments commence at a future date—typically upon retirement. For instance, you might arrange an annuity today that begins paying £1,000 per month starting from age 65.

While these are relatively common in the US retirement market, they're less prevalent here in the UK.

Here is my question:

“If I can’t buy a forward-starting annuity easily, how can I hedge the economic exposure using liquid assets available today?”

First, let's confirm that I’m on the right track by trying this approach for a standard annuity.

🛡️ Defining "Hedge"

When I refer to hedge, I mean:

> A collection of liquid assets that offsets as much of the economic exposure of a liability as possible.

In this context, the liability refers to the future annuity payments.

The emphasis on liquid assets is crucial because, in practice, the value of complex instruments—such as annuities and derivatives—often hinges on the cost of constructing a liquid, replicating hedge.

🧓 Hedging a Standard Single Lifetime Annuity

Consider a 65-year-old retiree who desires £1,000 per month for the remainder of their life.

While we can't predict an individual's lifespan, we don’t need to. Annuity providers rely on the law of large numbers: although individual lifespans are unpredictable, large groups of similar individuals exhibit very predictable mortality patterns.

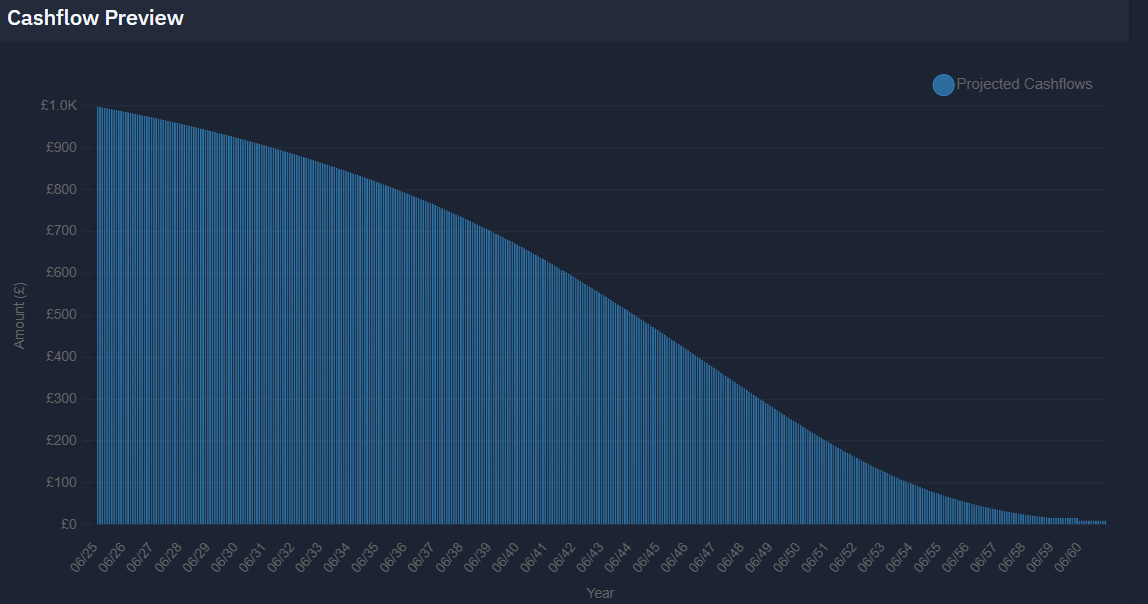

For each future month, we can multiply the desired payment (£1,000) by the probability of being alive in that month. This yields a survival-adjusted cash flow—a series of expected payments that decrease over time.

This is the liability we aim to hedge.

🛠️ Constructing a Hedge with Gilts

To hedge this survival-adjusted liability, I've developed a straightforward application that uses UK gilts to construct an accurate hedge:

👉

With this tool, you can:

1. Upload a CSV file of cash flows.

2. View the cost of the replicating hedge using actual market prices.

3. Explore how sensitive the cost is to changes in interest rates.

Let’s walk through the process:

- Generate the survival-adjusted £1,000/month cash flows.

- Upload them to the app.

- Obtain a hedge portfolio composed of gilts.

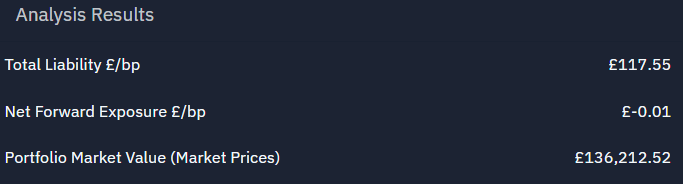

The market price of this portfolio, based on the closing prices as of April 4, 2025, was £136,212.52. According to this, a £1,000 per month annuity for a 65-year-old male (using male mortality data) should cost approximately £136,000. Or, in other words, £100,000 should get you £734 a month or £8,820 a year.

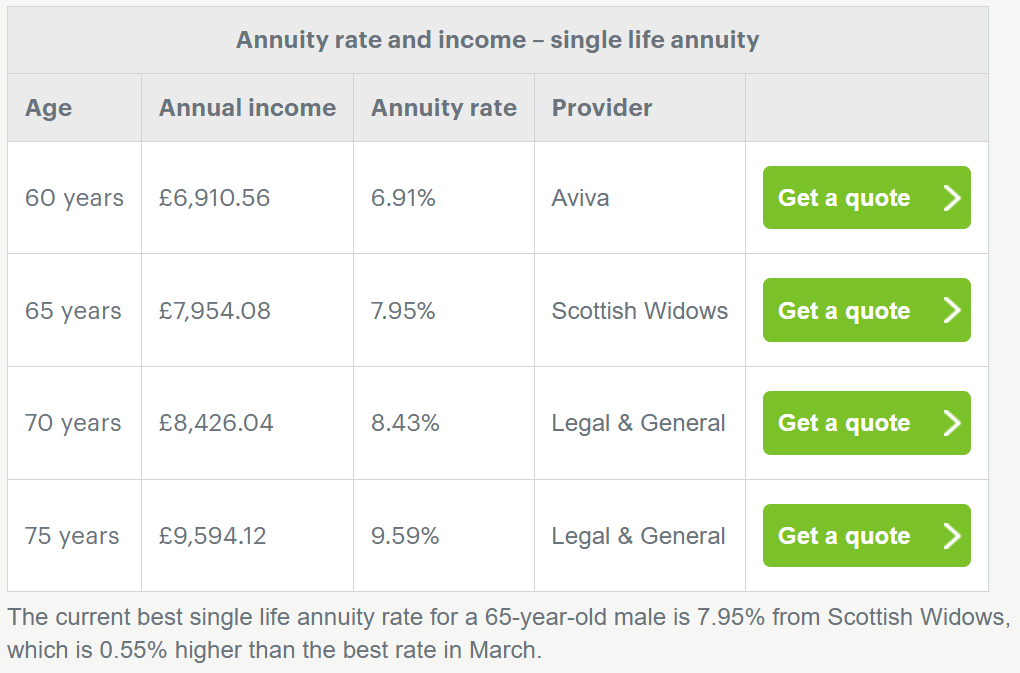

📊 Comparing to Annuity Rates

Next, let’s compare the hedge cost to published annuity rates in the UK.

The hedge cost above is approximately £800 higher than the best available market rate, suggesting that the annuity market is fairly efficient, albeit at a cost. Which is to be expected, really, the insurance industry is, after all, for profit and in addition has:

- Overheads and sales commissions

- Capital requirements

- Annuity buyer-specific mortality tables (healthier people tend to buy annuities)2

- Risk - The hedge above is not perfect (although I think it’s pretty good!).

Is a 10% cost fair after accounting for these factors?

🔮 Hedging a Forward-Starting Annuity

A forward-starting annuity simply means that our want-to-be annuitant is younger and the income payments begin at a future date—say, at age 65.

This implies that:

- The expected payments are scheduled to commence later.

- Survival probabilities are conditional on reaching that age.

- The hedge needs to be constructed using longer-dated assets.

Conceptually, however, the process remains the same.

Here’s the approach:

1. Generate survival-adjusted cash flows starting from the forward start date

→ e.g., from age 65, conditional on reaching 65 (from the current age - assumed to be 50 in this example).

2. Create a CSV file of those future payments.

3. Upload it to the Gilt Ladder Hedge App (https://gilt-ladder-hedge.replit.app).

4. Determine the hedge portfolio you'd need to hold today to match that future liability.

👉 Even though the income starts in the future, we still hedge it now using long-duration gilts.

Here are the results:

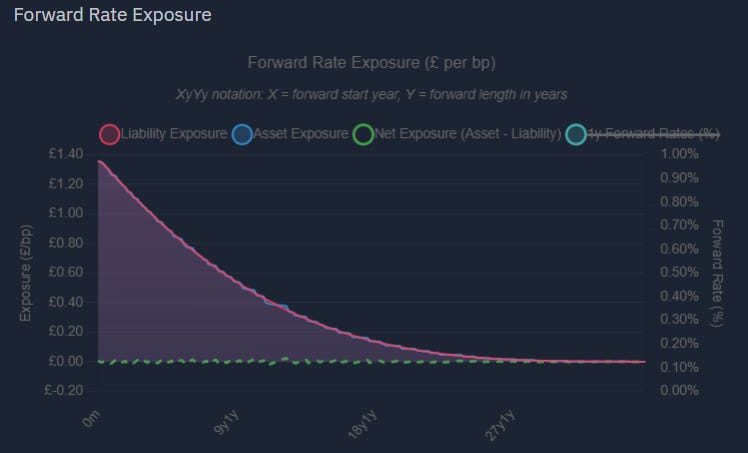

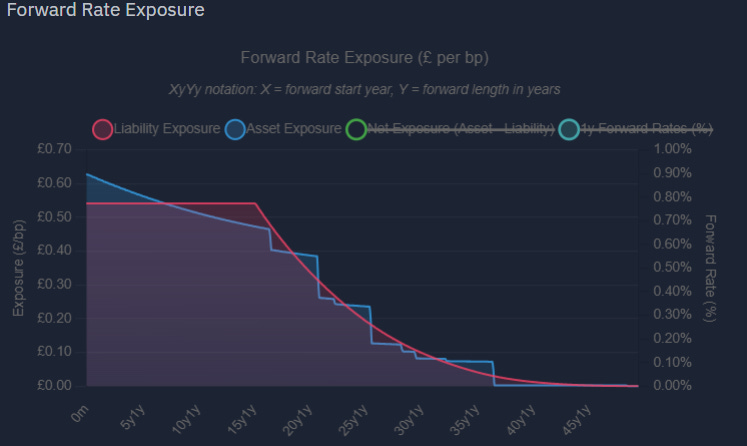

Given the limited availability of Gilts at the very long end, the cash flow profile is less well-matched than previously. In risk terms, it looks like this:

You can see the trade-off that has been made to match the liability profile. More exposed to near-term interest rate expectations and short the medium-term forward rates and a zig-zag of exposure beyond that.

So, if there were a more significant market in the UK for forward-starting annuities, we might expect to be able to obtain a flat rate of just over £1,500 per month or £18,000 per year, starting in 15 years' time, for the standard £100,000 today. However, we also need to account for the insurer's margin, among other factors, so a reduction of at least 10% to 20% is likely, given the additional risk.

Hopefully, this demystifies this subject to some extent, shifting the perspective from viewing them as “black box” products to understanding them in terms of:

- Mortality curves

- Cash flow ladders

- Real market instruments

Maybe this post will open up a range of opportunities for planning and product innovation.

🎯 Try It Yourself

👉

Upload a CSV and observe the hedge for yourself.

Begin with an immediate annuity. Then experiment with a forward-starting one.

If you'd like a sample CSV or mortality table, feel free to reply or comment below.

If this topic interests you, consider subscribing to stay updated:

If you found this article helpful, please share it with others who might benefit.

Thank you for supporting my SubStack!

Notice & disclosures:

• Personal capacity: Views are mine alone; not those of my employer or any client. This content has not been approved by any third party.

• No advice / no promotion: For information and education only; not investment, legal or tax advice. Not a recommendation or an invitation/inducement to engage in investment activity.

• Models & assumptions: Results rely on assumptions about rates, mortality, inflation, liquidity and execution. Back-tests, scenario analyses and forward-looking estimates are hypothetical and can differ materially from real outcomes. Data may (will probably) contain errors.

• Product caveats: Product features, pricing and availability (e.g., annuities, deferred terms) vary by provider and over time; terms may change without notice.

• Risk: Markets can move against you; you may lose money. Tax treatment depends on individual circumstances and may change. Seek advice from an FCA-authorised adviser.

• Conflicts: I may hold positions in gilts, index-linked gilts, swaps or related instruments discussed. Any material compensation or affiliations will be disclosed.

In practice, annuity providers hedge using various assets, such as corporate bonds and private debt, not just Gilts. With these additional assets, the insurer aims to cheapen the hedge further, thereby increasing its margin.

I’m not an actuary. The production of these more accurate mortality tables is a highly specialized job. However, I do know that longevity swaps trade at about 50 basis points a year, so that would account for a margin of about 5%.

So £660k in a pension at 50 could “lock in” the cost of a £10k [9k after insurance co take] a month pension at 65 - (single Life, Male).

Thought-provoking as ever