"Set For Life" Gilt Portfolio

£10k Per Month After Tax For Life (30 Years)

The National Lottery here in the UK has a game called “Set For Life”. The idea is that a ticket costing £1.50 could win you £10k a month after tax for 30 years.

What a great concept. The “Set For Life” one not so much the Lottery. £10k a month for 30 years! Fun, that’s what I want! Unfortunately, the odds of winning this Lottery are 1:15.3m. So not a great return given that 30 x 12 x 10,000 = 3.6m!

But it got me thinking, what would the risk-free portfolio look like that replicated £10k per month for 30 years? How much would it cost? Well, a quick spreadsheet later, and I have an answer.

Replicating the “Set For Life” cash flow with Gilts

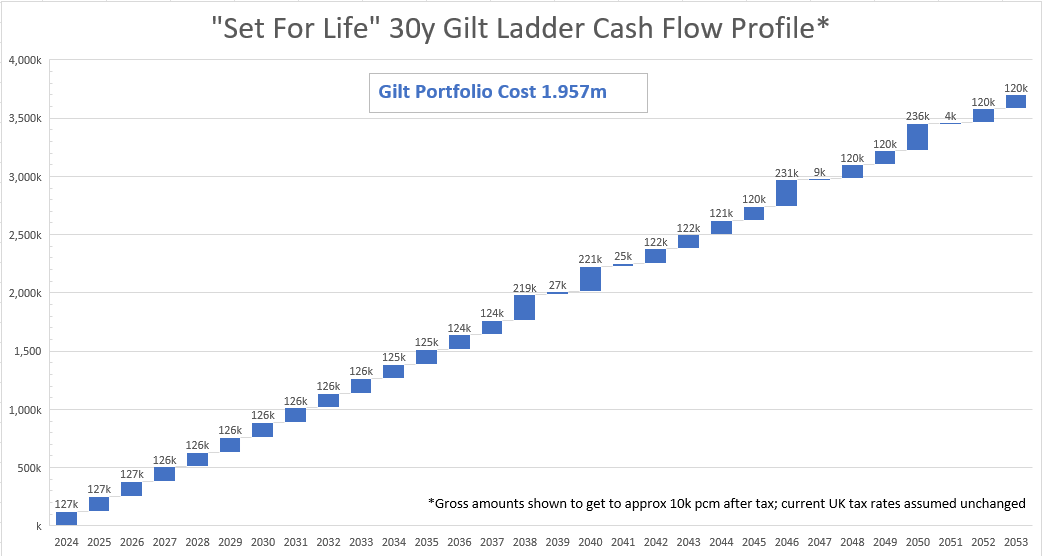

So it’s annual(ish) payments of a net £120k, not £10k each month, with maturities of the bonds pretty randomly distributed throughout the calendar, and there are coupon payments too. To get after-tax income, I assumed that the UK tax rates (not Scotland) were static for the whole 30 years (wishful thinking?) and that this was the only income.

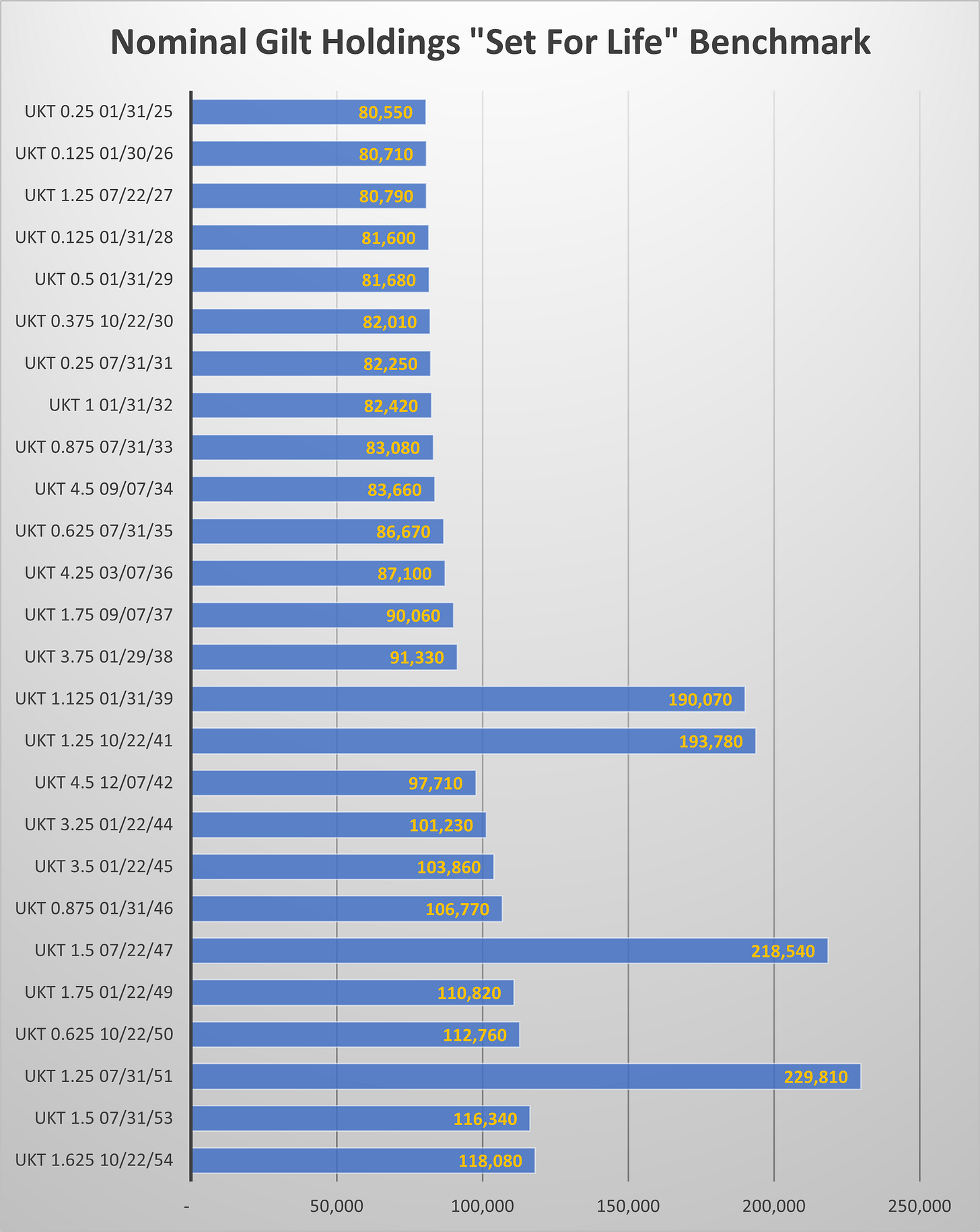

As you can see, there are some years where you get almost two years in one go; this is because there aren’t [yet] Gilts maturing in these years. The tax treatment of Gilts is also relevant; there are no capital gains on Gilts, but the coupons are taxable, so I made an effort to minimise the cash flow coming from the coupons. Here is the portfolio of Gilts and the nominal amounts that you’d need to buy:

The Gilt Portfolio

The cost to buy this portfolio on the 2nd November 2023 was about £1.96m. So £1.96m now to buy about 3.7m of future cashflows, of which 100k is tax payable (assuming this is only income and the other things above).

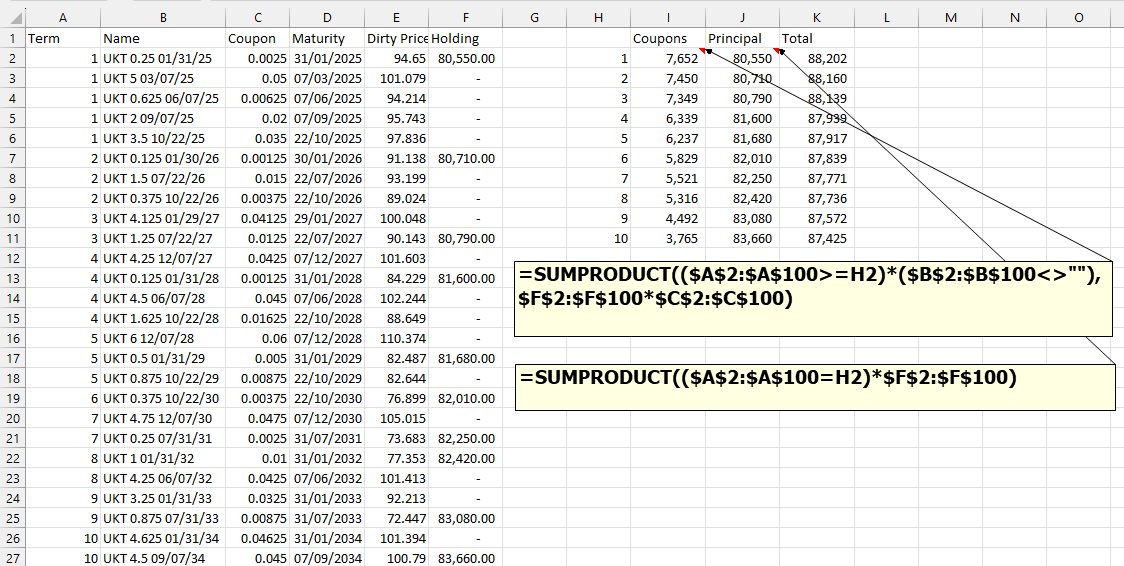

Simple spreadsheet

If you want to do this yourself, in a very rough and dirty spreadsheet way, you could do it like this:

After you have that, you can iterate or use a solver to work out the nominal holdings needed to get to a desired future cash flow profile. Multiply out by the dirty prices to get the portfolio cost. This process is nearly identical for bonds of other countries. You can do the same for corporate bonds, but the chance of a default complicates things.

Let me know if you want some explainers on this, or on how to do corporate bonds, or if you want my views on how to do this sort of hedging much more accurately.

What would a Modern Tontine add to this?

About

This is Modern Tontines, the start of a campaign to make Modern Tontines and Target Date Fund Ladders a reality. Modern Tontines don't exist yet despite them being a realistic solution [partial solution] to the looming retirement crisis. Target Date Fund funds exist, but not enough of them to make an effective ladder

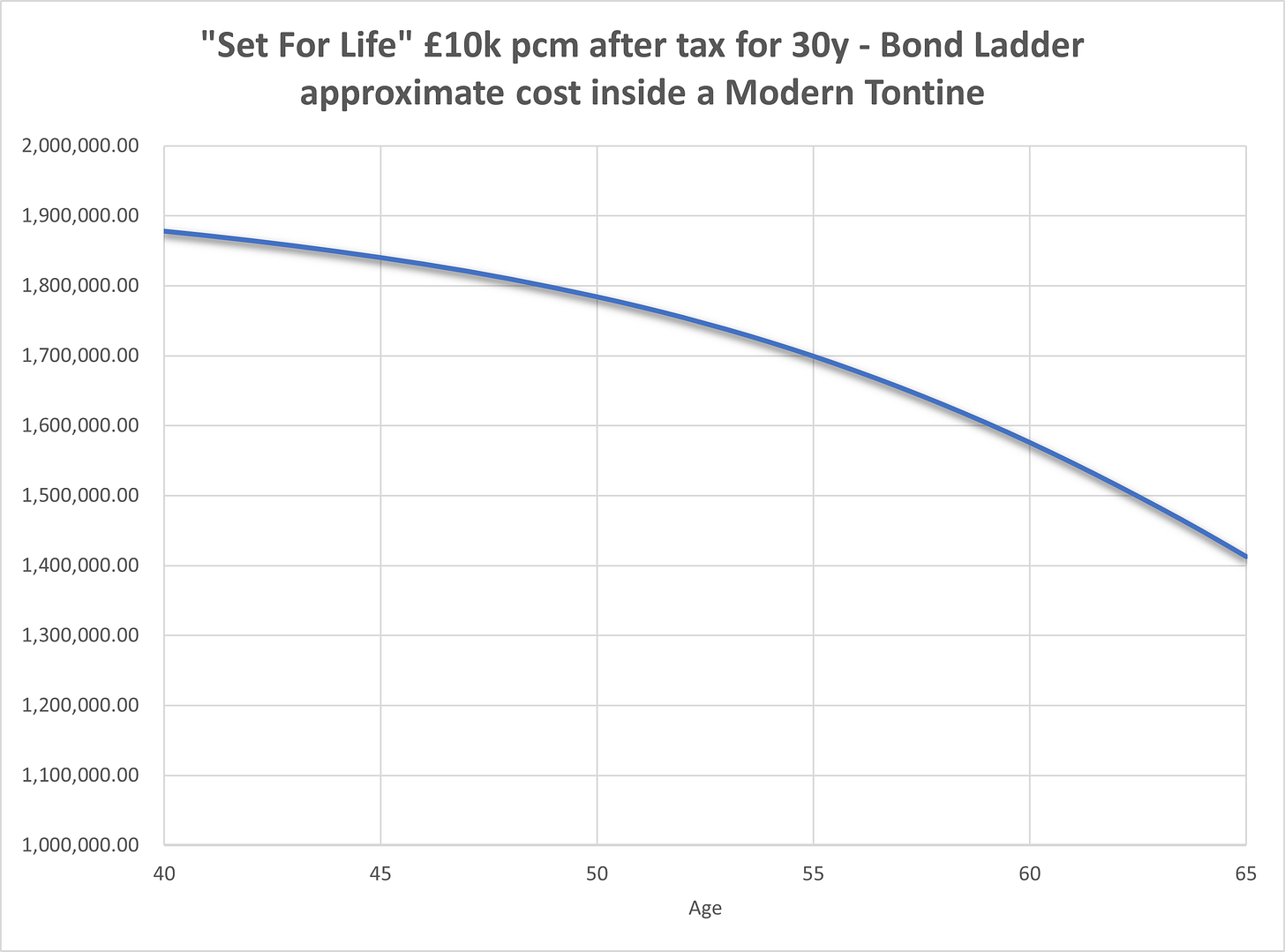

Okay, so a portfolio costing <£2m will buy a UK taxpayer the “Set For Life” Gilt Portfolio- but this blog is also about Modern Tontines, so my follow-up question is, what would you need to invest in a longevity sharing pool to be able to buy this portfolio? For the new to this blog, a Modern Tontine is a way to fairly share your survival probability with everyone else in a pool. If you did this, you don’t need to buy the full amount of that portfolio but rather your survival probability-weighted amount. See this paper for the maths.

Before you all say right, that works; let’s do that; there are a couple of important aspects to discuss. The first is that Modern Tontines don’t yet exist. Additionally, it’s not clear what sort of legal structure would be used or how the regulator would view it. So we need some innovation and the wealth management establishment or a disruptor to grasp the nettle and get one up and running.

In our view, there could be a substantial first-mover advantage to this. The maths that makes Modern Tontines fair is well established, and we have a cloud-based solution for wealth managers that would allow them to do the calculations efficiently.

The second is an obvious one: this is not a free lunch, and the downside is that your estate won’t get the residual of this portfolio if you die before the 30y is out, but presumably, you might have left some investments inside your pension pot for that eventuality.

Thirdly the gilt ladder might not be the optimal investment book for the individual. It’s just one of the options. For example, a ladder of Target Date Funds, with a sensible policy migrating from risk assets, could offer much better returns.

THIS IS NOT INVESTMENT ADVICE

This post is provided for informational purposes only and is not intended to provide, and should not be relied on for, investment, legal, or financial advice. Nothing in this post constitutes a solicitation, recommendation, endorsement, or offer by the author or their affiliated companies to buy or sell any securities or other financial instruments. You should always do your own research and consult with a licensed investment professional before making any investment decisions.

The Longevity Risk Conundrum:

As the clock ticks towards retirement, an ominous shadow looms over the golden years of countless individuals: the risk of outliving their savings. This longevity risk, amplified by the breakneck speed of technological advancement, is a growing concern for anyone facing the prospect of retirement.