The Hidden Link Between Credit Spreads and Equity Options

Option-Based Credit Spread Explorer | Inspired by Culp-Nozawa-Veronesi

Considering corporate bonds for steady income? What if I told you that buying a corporate bond (taking on credit risk) is a lot like selling an insurance policy on the stock market? 🤔 In other words, buying credit = selling equity options. This surprising parallel was a real lightbulb moment for me in understanding credit risk, and now I’ve built an interactive explainer app that lets you see the relationship in action. (Yes, there’s a link coming up for you to play with!)

A Lightbulb Moment: Buying Credit is Like Selling Options

When you buy a corporate bond, you lend a company money and earn interest (the yield). But you also take on the risk that the company might default (fail to pay you back). That extra yield above a safe government bond – the credit spread – is basically your payment for bearing that default risk. It’s analogous to how an insurance premium works.

Buying a corporate bond is like selling insurance against the company’s failure. You collect extra interest, but you could lose money if the company crashes (defaults).

Selling a stock option (specifically, selling a put option on an equity index) is like selling insurance against a market drop. You collect a premium upfront, but if the market crashes, you pay out.

In both cases, you're earning income as long as nothing goes too wrong, but you're on the hook if disaster strikes. Being long credit = being short volatility. If the market gets turbulent (high volatility) or the company hits a rough patch, the risk of default rises, just as the chance of an option payout rises.

Analogy: Think of a corporate bond investor as an insurer. The bond’s interest over and above the risk-free [Government] bond is like an insurance premium. A default event is like a house fire – low probability but high cost. Option sellers play a similar role, insuring against stock market crashes. No wonder the VIX “fear gauge” and credit spreads both tend to spike during crises like 2008 or 2020 – everyone suddenly demands a higher premium to bear risk!

Backing It Up with Research: Option-Based Credit Spreads

This isn’t just a neat analogy – there’s solid research behind it. A National Bureau of Economic Research paper by Culp, Nozawa, and Veronesi explores “Option-Based Credit Spreads.” The researchers created “pseudo-bonds” out of stock options to mimic corporate bonds. In their setup, a pseudo-bond = a Treasury bond minus a put option on a firm’s assets. Essentially, the pseudo-bond earns the risk-free rate and the option premium but takes a hit if the firm’s value plummets – just like a real corporate bond would.

What did they find? Remarkably, these option-based pseudo-bonds behaved just like actual corporate bonds:

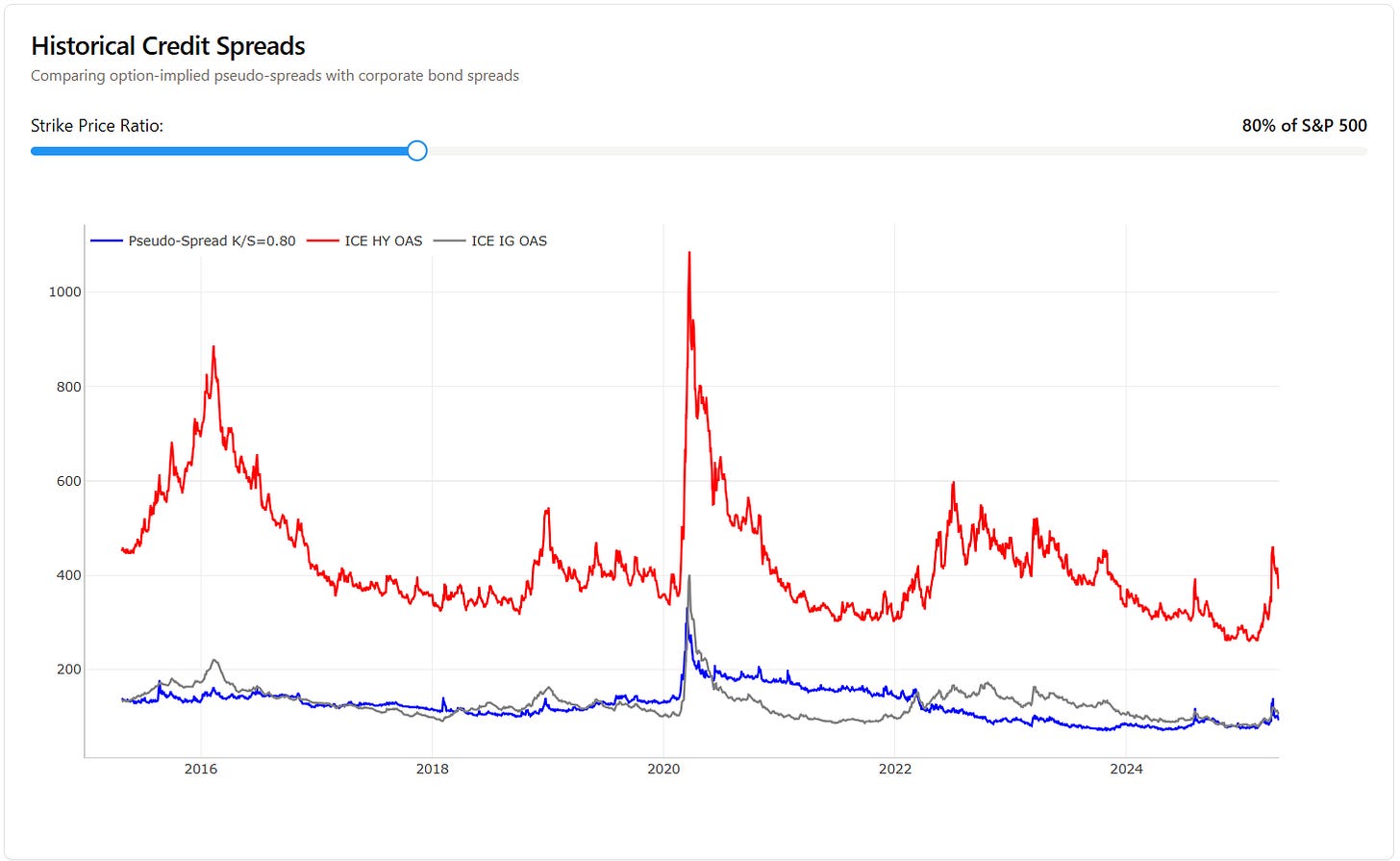

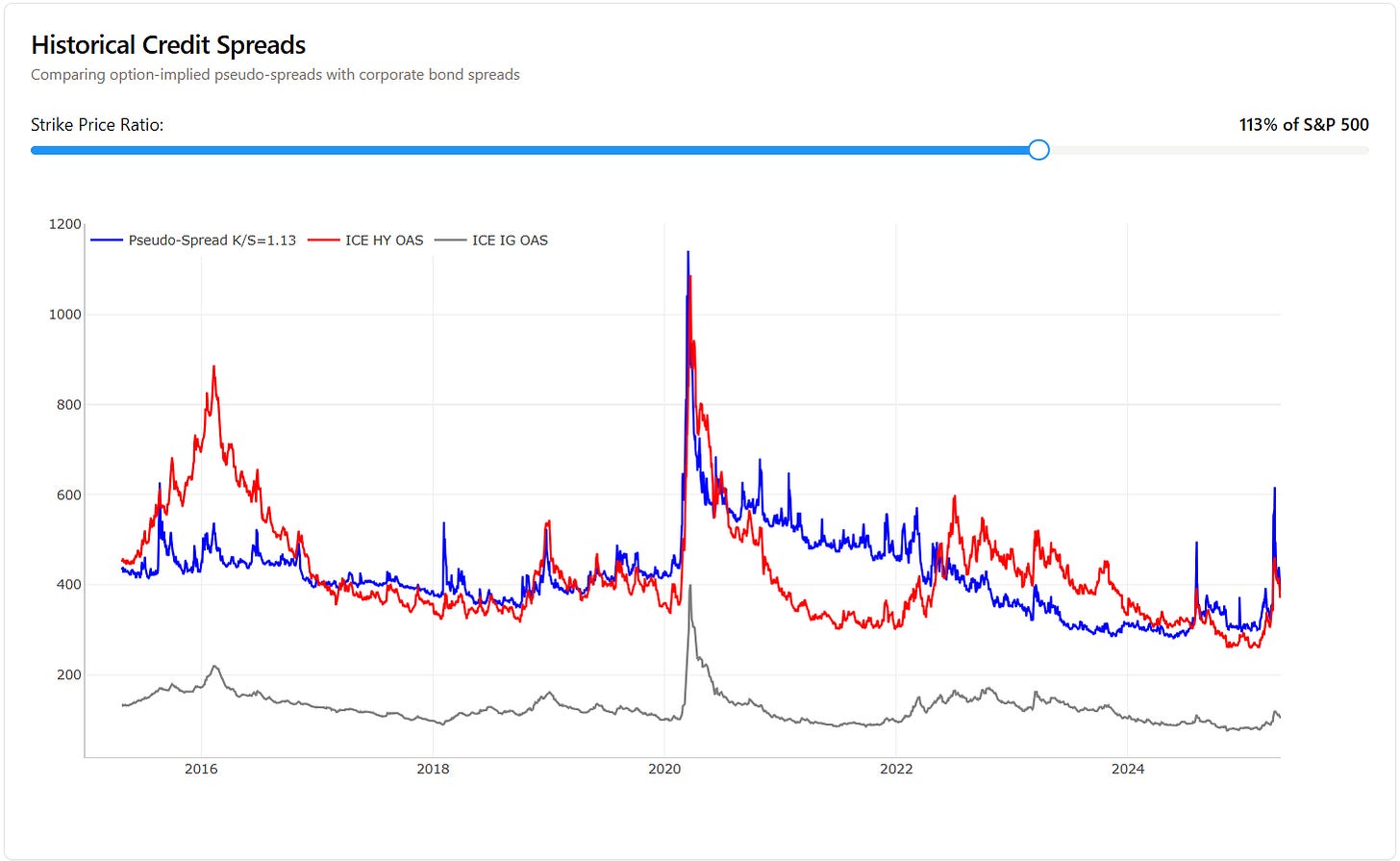

Big and Countercyclical Spreads: Pseudo-bond credit spreads were large and widened during periods of equity market stress, mirroring the behaviour of real corporate spreads. In both cases, spreads are large and strongly countercyclical — they tend to spike when economic conditions deteriorate or financial markets become volatile.

Risk Premium, Not Just Defaults: Credit spreads primarily reflect a risk premium for rare, extreme outcomes, not simply the expected cost of defaults. As Culp, Nozawa, and Veronesi describe, a "risk premium for tail and idiosyncratic asset risks" is the dominant driver of corporate spreads. Investors are compensated not merely for expected losses, but for bearing the uncertainty of catastrophic asset value shocks.

[c.f. a near future post on risk aversion].Strike Level and Leverage: The strike price on a pseudo-bond — the point below which losses occur — is directly analogous to the leverage of a real firm. Higher strike levels (closer to current asset values) correspond to higher leverage, just as high-yield corporates operate closer to default thresholds. In both cases, greater leverage amplifies sensitivity to asset value shocks and results in wider spreads.

These findings reinforce the idea that credit investors are effectively selling “crash insurance.” The pseudo-bond constructed from equity options captured that insurance component really well, matching real-world credit behaviour. It’s a great validation of the buy-credit/sell-volatility link – a true aha! moment when theory clicks with reality.

Risk-Free Approximation and Data Limits: The model I have built uses VIX index options and Treasury yields as proxies for asset volatility and risk-free discounting, incorporating standard adjustments for implied volatility smile and basic smoothing techniques. While this captures broad dynamics, a true one-to-one comparison, as in Culp, Nozawa, and Veronesi's work, would require traded options specifically matched to the maturities and structures of actual corporate bonds. In short, my model illustrates the mechanics, not an exact replication of the research.

Try It Yourself: Interactive Explainer App 🚀

Enough theory – sometimes you need to see it to believe it. I’ve built an interactive explainer app to illustrate this credit-volatility connection in a visual, hands-on way. Check out the explainer app here (no installation needed – it runs right in your browser).

What can you do with it? The app lets you play with scenarios that show how a corporate bond’s value relates to the volatility of an equity index. For example, you can tweak the implied volatility (the price of options) and watch how the equivalent credit spread moves. It’s like a mini sandbox for pseudo bonds: you’ll see how rising market volatility makes the “credit” part of a pseudo-bond more risky (wider spreads), and vice versa. The goal is to turn the abstract concept into something you can experiment with and intuitively grasp.

Feel free to pause here and give it a try. 👉 (Go on, it’s fun!) Adjust the sliders, see the outcomes, and have that lightbulb go off as the credit = short-vol concept becomes crystal clear. Make sure you change the option strike too to simulate different leverage levels for the pseudo bonds.

This app is part of my growing series of interactive explainers – you might recall the gilt hedging tool I shared previously. Now that I’m a fully fledged “vibe coder”, you’ll be getting more of these.

Implications: Would You Rather Sell Vol or Buy Credit?

Why does this connection matter for your portfolio? Well, if selling equity options and buying corporate bonds are cousins in terms of risk exposure, it raises an interesting question: Which would you rather do? Both strategies earn you a premium (option premium or credit spread) for bearing risk. But they might play out differently in your portfolio:

Selling Equity Puts: This could mean writing options on an index (or using strategies like put-spreads on ETFs). It can generate income, and historically, the volatility risk premium has been sizable. However, it’s very transparent – when markets crash, you’ll see immediate losses. It’s a direct bet against volatility spikes. It also feels scary, with words like “unlimited loss” often, incorrectly, associated with selling options!

Owning Corporate Bonds: You earn that extra yield, and bonds might feel safer or more familiar for many investors. However, in a severe market downturn or recession, even investment-grade corporate bonds can suffer defaults and their price drops with every volatility spike. The risk can feel hidden until a default happens.

This is a thought-provoking comparison. If you’re comfortable with one, you’re implicitly taking on a similar risk as the other. Some might prefer the transparency and liquidity of equity options; others might prefer the seeming steady income and structure of bonds. One might offer better returns depending on the market at the time. Or you might diversify and have both? There’s no one-size-fits-all answer, but understanding the link is key and a reminder to reminder to really think about diversification!

Wrapping Up: Learning and Exploring

Hopefully, this discussion and the interactive app serve as that “aha!” moment, making a complex concept click. I encourage you to explore the app and ponder the parallels.

As part of this newsletter’s mission, we’ll continue to bring such insights to life with interactive tools and clear explanations. If you enjoyed this, stay tuned for more in our series (and feel free to revisit the earlier gilt hedging post).

Happy exploring, and as always, thank you for reading! Feel free to share your thoughts: Would you rather be an equity option seller or a credit investor, and why?

This blog is focused on promoting Modern Tontines and exploring overlooked financial concepts and strategies. My aim is to simplify complex financial concepts and demonstrate practical ways to think about secure retirement income and liability matching.